Majority of people still seem to be unhappy and unsatisfied with their life and surrounding socioeconomic situation despite the highly available technology and the robustly growing aggregate productivity and wealth as well as stock price indices. The study of economics has often focused on the gross domestic product for scaling the economic well-being. Furthermore, these economists still consider money (fiat-currency) as the intermediary of the exchange all the time so they assume the excess money supply not corresponding to the market demand triggers a high price inflation.

These factors must have been true up to just recently. Nonetheless, the paradigm of the world socioeconomics has certainly significantly shifted from this classical case. Moreover, the inflation risk due to the expanded money supply can be quite likely to be a superstition which is not worth off to be scared of. Well, this does not mean to prioritise controlling the employment over controlling the inflation such as the Phillips curve. It means to suggest not to be excessively scared of the inflation by means of increasing the money supply.

The proactive monetary policy has traditionally focused on increasing the aggregate supply offsetting the price inflation by the high output for the return. Nowadays, in such a post-industrialised world, there is no exact industry which promises to offset the negative effect from the inflation by directly injecting the money supply. In another word, the aggregate supply is already high enough to satisfy individuals and their life; The only concern is its diversification i.e. the re-distribution.

There is a reason why it is already unnecessary to be afraid of the inflation. Nowadays, whenever there is an excess demand or an lacking supply takes place, there is always another supplier jumping into the market to fill the output gap. The speed of the information flow for both financial investment and resource managements including logistics and invention is so high that the macroeconomic gap is immediately reduced.

Then, it comes to the point of applying the money supply. The most critical point is that these economists still narrow mindedly focus on the GDP. The GDP is the gross term which can be artificially increased by increasing the several unproductive turnovers so it is not an articulate measure of an economic well being even in the aggregate level.

More turnovers implies more environmental damages because of the increased logistics consuming fuels and production processes consuming resources. Therefore, excessively focusing on the GDP may encourage the environmental destruction. This is another reason to discourage excessively focusing on the GDP.

In addition to these material factors, there is also an ethical concern on excessively focusing on not only the GDP but also any other gains in the financial terms. When individual economic agents keep competing to maximise their sales volume and financial gain, it comes to the point majority of them working hard face difficulty to survive in such an ultra competitive market. It eventually induces either a cut-throat competition where everyone loses or a monopoly/oligopoly where only few powerful economic agents monopolise the gain.

In such a socioeconomic model, individuals are simply exhausted for working hard enough to neglect the other important elements of their life such as family and friend kinships, cultural activities such as arts, sports, and local festivals, and most importantly sparing their time for their physical and mental health.

It is often wondering why individuals cannot enjoy their life without working so hard. The top 3 countries of the highest GDP are the USA, China, and Japan in which their citizens are expected to work very hard to prop up themselves. Their income gain opportunity maybe high although the price indices i.e. their costs of living are also high.

In addition, the income inequality (the relative poverty in another word) of the USA and China is significantly high enough to cause various social problems related to the relative poverty. The income inequality, the relative poverty, of Japan has been substantially rising since 1990s so that social problems related to the relative poverty has been rising since then.

Many people have started wondering if working hard to increase the GDP is really worth-off to consider their well-being in general. This is why the alternative measure such as the Happy Planet Index (HPI) introduced by New Economic Foundation has become popular as an alternative of the GDP for scaling the socioeconomic well-being.

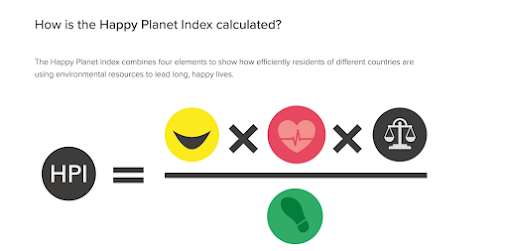

This HPI is calculated by the power of three variables, the survey points of happiness, the average life expectancy, and the income equality (the lowness of the relative poverty) divided by one variable, the ecological foot print (the environmental damage).

The first variable is a simple surveillance asking randomly picked up people in a country for scoring their happiness from the point up to 10. This can be subjective and often affected by the climate effect (See also my blog article "Happiness related to Monarchy, One Party, and Democracy"). Nonetheless, it is still an important variable directly measuring whether people are happy overall.

The second variable is a simple and ostensible measure scaling individual people's health and their security in their living society. An access to a healthy nutritious diet, satisfactory health services, and a clear natural environment free from pollution, a positive prospect with a low anxiety at the present time period, and a safe community preventing its citizens from mortal incidents.

The third variable has been newly introduced recently. It may be because the social problems related to the relative poverty are non-negligible to take individuals' happiness into consideration. When the income inequality dispersion among individual citizens is significantly big, many citizens become difficult to afford their basic necessities as well as some luxuries because the price goes up due to the monopoly effect by the rich. Moreover, many individual citizens tend to feel miserable because they feel like being less worth off than the very fortunate rich cohort of individual citizens. This is why the crime rate as well as the suicide rate tend to go up when the inequality dispersion is widened.

The forth variable indicates the penalty of exploiting natural environments by such as natural resource extraction and various kinds of pollutions harming natural environment. This claims for a need of the counterweight against economic activities deserving human individuals. In particular nowadays, socioeconomic indices should take the sustainability of both individuals themselves and their living environment of the mother earth.

There are many scepticisms against the HPI, and some of them are really articulate and plausible the disadvantages of referring to this index. Well, nobody has yet ever discovered a perfect index measuring the socioeconomic well-being overall. In another word, no index is perfect. However, the HPI seems to be at least more useful, precise, and demanded to scale the socioeconomic well-being especially at the current time period when the paradigm has started shifting and this shift is still in progress.

Having taken these aforementioned factors into consideration, an economic policy of this new paradigm of this world will needs an alternative measurement of the money supply control to the counterpart implemented by the current status-quo. In order to allow a national/regional economy to prosper, it requires to install a brand new innovative economic policy not shown in a regular text book especially these days of this paradigm shift.

It will be kind of imitating the economic policy of Korekiyo Takahashi who used an amazing completely innovative policy which was resemblance to Keynesian economic policy although it was way before J.M.Keynes published General Theory of Employment, Interest, and Money.

At his time period, the monetary policy theory assuming money (fiat-money) is neutral as it is merely an intermediary of exchange. This classical economic theory therefore regards that money supply is neutral to economic activities i.e. it is meaning less to supply an excess money for those which do not exist at the present time period (Money supply adjusted to the existing economic output).

By contrast, Mr. Takahashi proactively injected the money supply into various ongoing public work projects such as various infrastructure constructions like building ports. His policy was dedicated to inject the public goods and services not having existed at the time this monetary policy was implemented. This was entirely a new innovative original economic policy not having been mentioned in any textbook at the contemporary time period!

There is a reason to claim for reincarnating Takahashi-ist monetary policy into the present world. The private banks tend to be very reluctant to invest to those which may increase the HPI while not directly returning the financial return for their investment immediately. A further rise in the socioeconomic well-being, maybe represented by the

HPI, nowadays may require an immense public sector support such as the

monetary policy channel by acentral bank.

Regardless of either a private sector or a public sector a central bank is, a central bank and its function should be considered as public goods and services which are ought to deserve the public well-beings without concerning about the internal profit maximisation. A central is least likely be bankrupt among all the other banks as long as people keep using and trusting their supplied money (fiat-currency).

For example, it may be the time to re-evaluate the importance of artists and writers being suppressed by the importance of business persons and manufacturers. Artists and writers themselves are hard jobs to create the immediate cash but some of them will be remarkably successful enough to advertise their local community and nation they are brought up in. Then, when a policy allows more individuals to spend their life for their own activities of art and writing without their financial anxiety, the probability of bringing up future celebrity artists and writers may rise.

Not only the previously mentioned quasi-idealist policy but also there is a very emerging realistic matter to deal with to increase the HPI. As a matter of fact, almost all the countries in the world are not sufficiently investing their public expenditure to education and health services which are crucially correlated to the HPI. The current world economy demands the tertiary education e.g. university as though it were mandatory. Monetary investment tends to be often diverted from medics and healthcare because they hardly provide the immediate financial returns.

Adam Smith, the father of economics, even stated that defence, education, and healthcare could not be considered to grow in a free market economy. Smith put emphasis on the necessary public supports for defence, education, and healthcare regardless of their profit maximisation and the free trade while their existence is mandatory for letting the entire economy and society to prosper. Thus, even though an investment into education and medical services are not directly converted into the internal profit, there must be a way to ensure enough resources are secured for these institutes being in charge of education and healthcare.

Korekiyo Takahashi must have realised what Adam Smith mentioned there. At the contemporary time period of Japan, the military infrastructure was a priority to invest while many private sectors were reluctant or unavailable to invest in order to secure their trade routes and defend the nation. In order to enable the national economy prosper, these infrastructure categories, defence, education, and healthcare are crucial to exist even though the private investors were reluctant to invest.

This is the time to recall Takahashi-ist economic dynamic today. There are always something not directly related to the economic outlooks while they must exist to back the entire economy as well as all individuals and their society to prosper. Even though it does not directly contribute to the financial market or the economic outlooks, popular arts and subcultures will attract more foreigners to a region brining up such talented characters. A well established culture backed up by education, healthcare, and innovative minds may attract many entrepreneurs to obtain their new inspiration to start their business.

All in all, it is never a nonsense to combine the monetary supply channel of the monetary policy and the cultural and mental well-beings such as those represented by the HPI. Manifesto Neo-Takahashi-ism is here!